By Donald Phipps, Founder-CEO, Applied Marketing Research

As a researcher, I’m surprised by how some companies are stuck in what I call the “snapshot paradox.” These firms view research as a way to solve a current marketing dilemma while failing to think of research as a way to anticipate problems, adapt more readily to the future, and stay abreast of trends that may affect their markets.

That’s why I’m always happy to see firms undertake longitudinal studies. In marketing research, these studies can take the shape of “pre and post” research or, even better, tracking studies that extend over a period of time and are re-calibrated as necessary to deal with ongoing changes in the market while retaining a core set of questions that track attitude, usage, awareness, brand identity or other important aspects of the firm.

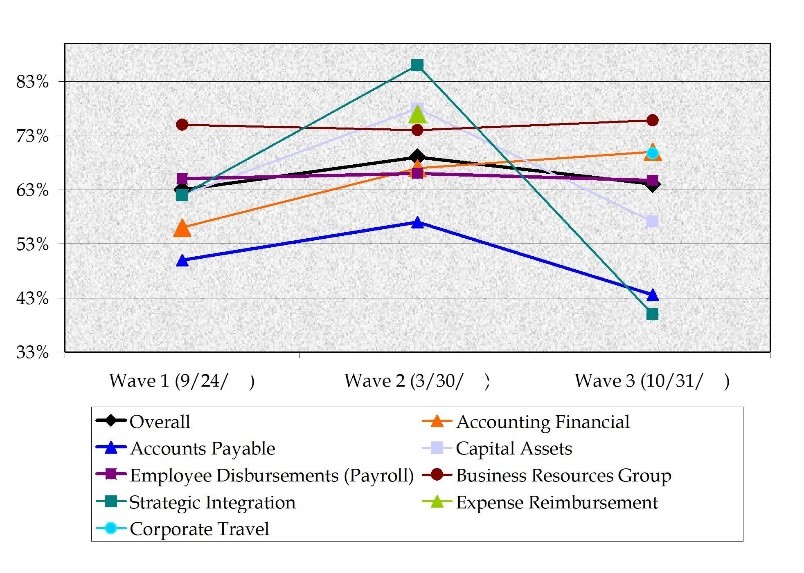

Figure 1. Tracking Satisfaction Research

I’ve worked on a number of these studies. Often firms that employ longitudinal studies benefit from seeing how their firms are doing over time. The three waves depicted above show how satisfaction with various corporate departments within a firm can change over time.

These kinds of changes can also be mapped for brands and markets. For example:

- Are customers happy and satisfied with my products/services and is this changing over time?

- Are new technologies impinging on my ability to maintain my markets? Can they be turned to my advantage?

- Are customers aware of my products/services and how does this stack up against my competition?

- Are customers adopting my product/services at an increasing or decreasing rate and how does this stack up against my competition?

- How are my social media impressions and conversion tracking over time? Up or down?

Another great aspect of this kind of study is the ability to determine the effect of a new element in the marketing mix (a so-called experimental design). For example:

- Before my new product rollout and after

- Before my new ad campaign and after

- Before my new content marketing initiative and after

- Before we undertook an initiative to improve customer service and after

- Are we seeing a bump in millennial usage over time or not?

- Before and after I changed my distribution model (example – “brick and mortar” to on-line)

Again, tracking consumer opinion over time allows you to determine whether your moves have been successful, what is working and what is not, and what changes can be done to increase opportunities with target markets.

One key to successful longitudinal studies is sample size. As with most quantitative research, you want to see your margin of error at around the ±5% level (roughly 400 respondents). And remember, you may also want to see this at a segment level – for example, Gen Z, Millennials, Gen X, and Boomers. For each segment you are tracking, consider boosting sample size so that comparisons between the segments can be confirmed. The same is true of other segments – customers or prospects, those that have purchased and those that plan to purchase, those that have purchased a specific product and those that only considered (and/or rejected). These various benchmarks can provide helpful insight into knowing what strategies and tactics to employ to drive market share success.

Taking a snapshot survey will not offer this kind of insight. Good tracking to you!